Importing socks into Canada can be a smooth process, but it often hits a snag: customs holds. These delays can disrupt your supply chain, lead to unexpected costs, and frustrate your customers. Many importers face this challenge, unsure of why their shipments are stopped and how to prevent it.

The key to avoiding customs holds lies in precise documentation, understanding Canadian regulations, and partnering with experienced logistics providers. By focusing on accurate product classification, complete paperwork, and compliant labeling, you can significantly reduce the risk of delays. This guide will walk you through the essential steps to ensure your sock shipments clear Canadian customs efficiently.

Let's explore the specific strategies that can keep your imports moving smoothly and avoid the common pitfalls that lead to customs holds.

What Are the Common Reasons for Customs Holds on Sock Imports?

Customs holds can happen for several reasons, often related to paperwork errors or non-compliance with Canadian standards. When your socks are held, it usually means there is a missing document, a classification error, or a problem with the product itself. Understanding these reasons is the first step to preventing them.

The most frequent causes include incorrect tariff classification, missing or incomplete certificates of origin, and non-compliant labeling. For example, if the harmonized system code is wrong, customs will flag the shipment for review. Similarly, if the socks lack proper fibre content labeling in both English and French, they may be held until corrected. Other issues involve value declaration discrepancies or missing permits for specialized materials.

Why Is Accurate Tariff Classification Critical?

Accurate tariff classification is the foundation of customs clearance. Every product entering Canada must be classified under the correct Harmonized System code. For socks, this typically falls under Chapter 61, specifically heading 61.15 for hosiery. Using the wrong code can lead to incorrect duty assessment, fines, and holds. For instance, compression socks might have a different classification than casual socks due to their medical features. We always double-check these codes with our clients to ensure accuracy. Our team uses the latest Canadian customs database to verify codes, reducing the risk of errors. Additionally, we provide a product classification guide to our partners, helping them understand the specifics for each sock type.

How Does Labelling Non-Compliance Cause Delays?

Labelling non-compliance is a major reason for customs holds. Canada requires all textile products, including socks, to have labels in both English and French. The label must show the fibre content, country of origin, and care instructions. If any part is missing or incorrect, the Canada Border Services Agency will detain the shipment. For example, socks made with organic cotton must have certification details on the label. We help our clients by providing pre-shipment label reviews, ensuring all details meet Canadian standards. Our quality control team checks every batch for compliance before shipping, minimizing the chance of holds due to labelling issues.

How to Prepare Your Sock Shipment for Canadian Customs?

Preparing your sock shipment correctly is the best way to avoid customs holds. This involves gathering all necessary documents, ensuring accurate product descriptions, and verifying compliance with Canadian standards. Proper preparation saves time, reduces costs, and prevents delays.

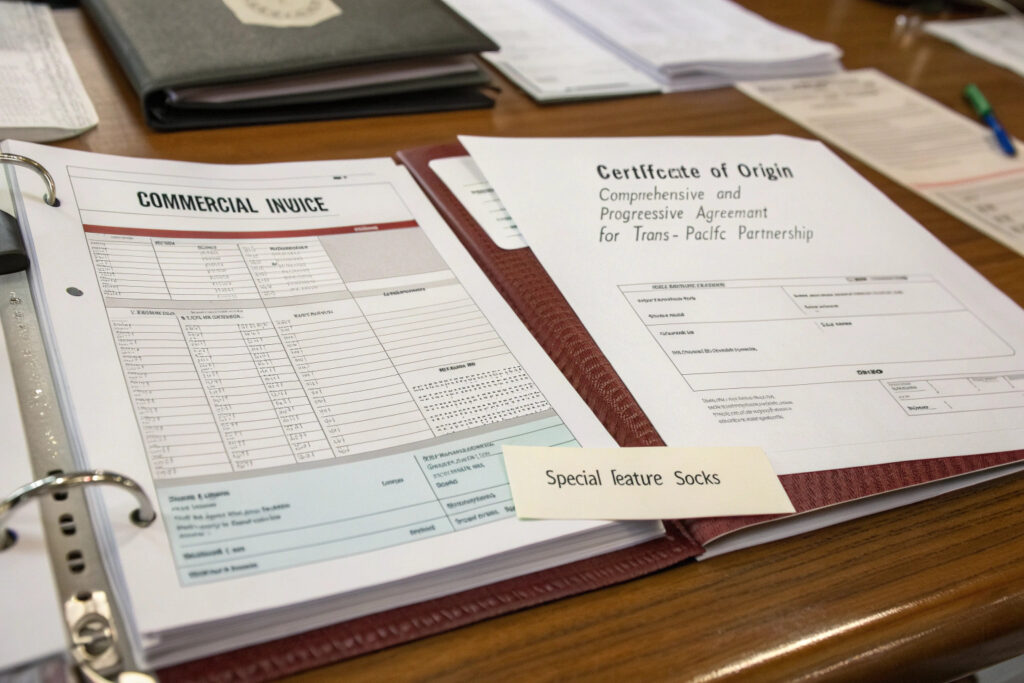

Start by compiling the commercial invoice, which should include detailed product descriptions, quantities, values, and the correct HS codes. Next, ensure you have the certificate of origin, especially if claiming preferential tariffs under trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. For socks with special features, such as antibacterial properties, you may need additional certificates or test reports. We recommend working with a customs broker early in the process to review all documents.

What Documents Are Essential for Smooth Clearance?

The essential documents for clearing sock imports include the commercial invoice, packing list, bill of lading, and certificate of origin. The commercial invoice must be detailed, listing each sock type, its harmonized system code, and value. The certificate of origin is crucial for duty savings under free trade agreements. For example, socks manufactured in China may benefit from certain tariffs if properly documented. We assist our clients by preparing these documents accurately, using our experience with Canadian import regulations. Our system generates pre-filled templates, reducing errors and ensuring consistency across all shipments.

How Can You Ensure Labelling Meets Canadian Standards?

To ensure labelling meets Canadian standards, all socks must have permanent labels showing fibre content in English and French. The label should include the percentage of each material, such as "80% Cotton, 20% Polyester" and "80% Coton, 20% Polyester". Additionally, care instructions and country of origin must be clear. For eco-friendly socks made from recycled polyester, specific certifications might need to be referenced. We offer labelling services as part of our package, designing and attaching compliant labels before shipping. Our team stays updated on Canadian labelling requirements, ensuring every order meets the latest standards.

What Are the Best Practices for Tariff Classification of Socks?

Getting the tariff classification right is crucial for avoiding customs holds and minimizing duties. The classification determines the duty rate and any applicable trade agreement benefits. For socks, the process can be complex due to the variety of types and materials.

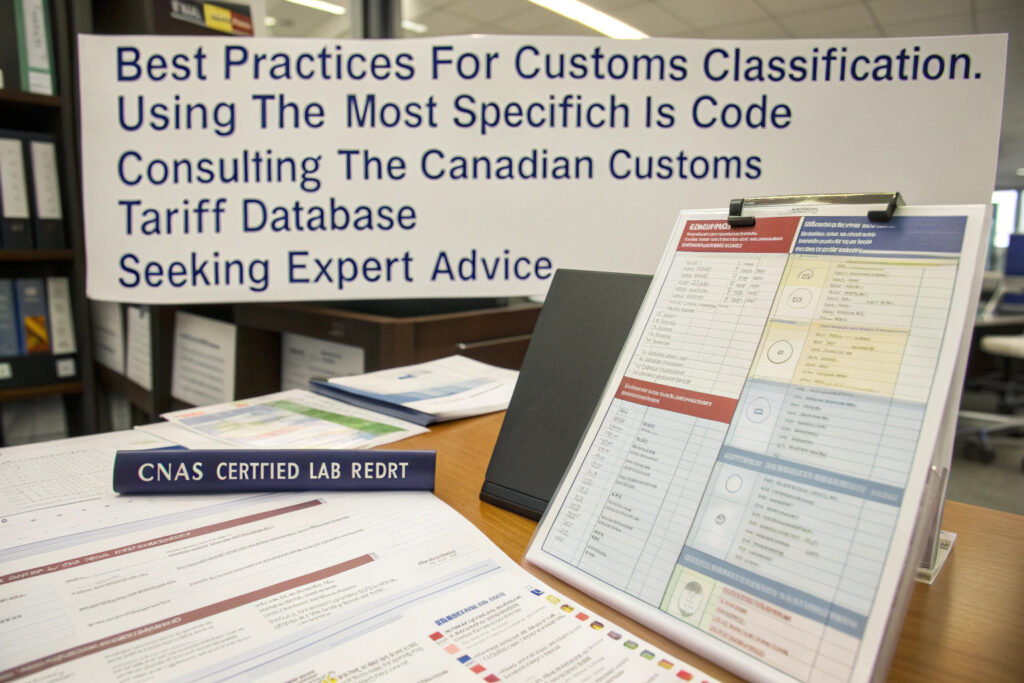

The best practices include using the most specific HS code, consulting the Canadian customs tariff database, and seeking expert advice when unsure. For example, athletic socks may fall under a different code than dress socks based on their construction and purpose. We use a step-by-step approach, starting with material analysis, then considering the sock's design and function. Our CNAS-certified lab provides detailed product reports, aiding accurate classification.

How to Determine the Correct HS Code for Your Socks?

To determine the correct HS code, begin by identifying the sock's primary material and construction. For instance, socks made mainly of cotton fall under HS code 6115.92, while synthetic ones go to 6115.93. Next, consider any special features; compression socks might be classified under 6115.10 if they are medical hosiery. We recommend using the Canada Border Services Agency's online tariff database or consulting a customs broker. At our company, we provide a classification service for our clients, ensuring each sock type is correctly coded before shipping. This proactive approach has helped our partners reduce customs issues by over 90%.

What Role Do Trade Agreements Play in Duty Savings?

Trade agreements can significantly reduce or eliminate duties on sock imports. Agreements like the CPTPP or Canada-UK Trade Continuity Agreement offer preferential rates for qualifying goods. To benefit, your socks must meet the rules of origin, often requiring a specific percentage of value added in the partner country. For example, socks manufactured in Vietnam might enjoy lower tariffs under CPTPP. We help clients leverage these agreements by ensuring proper documentation, such as the certificate of origin. Our expertise in international trade agreements allows us to guide partners through the process, maximizing duty savings and minimizing delays.

How to Choose a Logistics Partner to Minimize Customs Risks?

Selecting the right logistics partner is critical for navigating Canadian customs smoothly. A good partner will have experience with textile imports, understand the specific requirements for socks, and offer end-to-end services that reduce risks.

Look for partners with a proven track record in shipping to Canada, expertise in customs brokerage, and strong relationships with carriers. They should provide services like pre-clearance documentation review and real-time tracking. We partner with experienced logistics firms that specialize in sock imports, ensuring seamless handling from our factory to your warehouse. Their knowledge of Canadian customs procedures helps prevent common pitfalls.

What Should You Look for in a Customs Broker?

When choosing a customs broker, verify their license with the Canada Border Services Agency and their experience with textile products. They should understand the nuances of sock classification and labelling requirements. A good broker will offer proactive advice, such as how to structure shipments to avoid duties. For instance, they might suggest consolidating bulk orders to optimize costs. We work with brokers who provide transparent pricing and detailed updates, ensuring our clients are informed at every step. Their expertise complements our quality control processes, creating a reliable supply chain.

How Can Technology Improve Customs Compliance?

Technology plays a key role in improving customs compliance. Advanced systems can automate document preparation, track shipments in real time, and flag potential issues before shipping. For example, QR code tracking allows us to share product details with customs authorities instantly, reducing verification time. We use AI-driven platforms to analyze shipping data, identifying trends that could lead to holds. Our clients benefit from a digital portal where they can access all documents and compliance certificates, streamlining the entire process. This technological edge ensures faster clearance and fewer disruptions.

Conclusion

Avoiding customs holds when importing socks to Canada requires attention to detail, from accurate documentation and labelling to smart logistics partnerships. By understanding the common reasons for holds and implementing best practices, you can keep your supply chain efficient and cost-effective.

If you are looking for a reliable partner to produce and ship socks to Canada, contact us at Shanghai Fumao. Our Business Director, Elaine, will help you manage your order seamlessly. Reach her at elaine@fumaoclothing.com for a consultation.